European air conditioning market update 2024

[edit] 2024 highs and lows across European Air Conditioning market

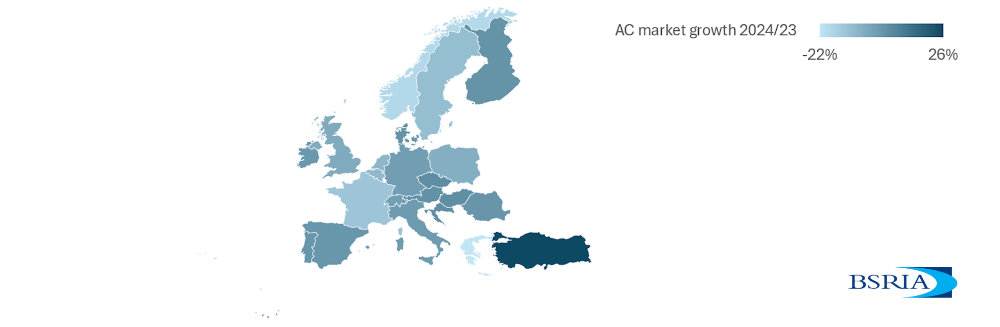

Research published in February 2025 by BSRIA on the European Air Conditioning markets revealed how volatile markets have become in response to a variety of conflicting factors driving and pushing back sales. The overall regional sales posted some growth in 2024, reaching market value above 18 billion dollars. However, the good performance has not been equal across the countries and the segments.

Water-based AC segment held up well, posting an annual growth rate of 5.6%, compared to a 1.4% increase in the packaged AC segment.

The launch of the European Green Deal and deployment of National Energy Plans have supported renovation projects boosting sales of chillers in 2024, but political debacles and economic hardships have taken toll in some countries curbing ambitions of private and public investors.

AC sales, particularly in residential segment, are driven by replacement and refurbishment sectors, and factors like high inflation, high borrowing cost or uncertainly of employment impact consumer confidence. Many European countries have also seen decrease in new construction activities, which translated in slowing sales, in both, residential and commercial segments.

Among the biggest European AC markets, Italy, Turkey, and Spain have seen positive market progression, but sales in France, Germany and UK have been disappointing in 2024.

Key Scandinavian markets, Sweden and Norway have also experienced significant decrease in sales.

The picture varied greatly in other European countries, where sales results spanned between double-digit decrease and double digit growth in comparison towards last year’s results.

[edit] High discrepancy rates in the annual demand for AC units

The trend towards reversible systems has stayed upward, underpinned by the good results in the screw and scroll chillers growth. Reciprocating heating and cooling chillers for comfort followed a positive development too, but volumes were marginal. Previously, the use of reciprocating compressors was limited to process applications, but latest development which allows for the use of hydrocarbon refrigerants made them suitable for comfort heat pump applications, for instance in Switzerland, Denmark and Norway.

BSRIA’s Worldwide Air Conditioning portfolio provides reliable market data, derived from BSRIA proven methodology which, for the last 30 years, has followed rigorous definitions and transparent process, allowing for reliable assessment of historical trends, current sales, and future forecasts. BSRIA data are indispensable for a development of credible strategic insights into the industry’s trajectory. The Air Conditioning reports untangle complex global AC markets and deliver data on product sales by type, with insights into product characteristics, like capacity, compressor types, refrigerants used and applications. BSRIA AC country reports help to understand the driving forces and obstacles affecting the markets and provide informed forecast for the incoming 5 years.

For further information on European Air Conditioning country reports, please contact our sales department wmisales@bsria.com.

This article originally appeared on the BSRIA news and blog site as 'European Air Conditioning Market Update' dated February 2025.

--BSRIA

[edit] Related articles on Designing Buildings

- Air conditioning.

- Air conditioning inspection.

- Air handling unit.

- Building services

- Chilled beam.

- Chiller unit.

- Chilled water.

- Cooling systems for buildings.

- Displacement ventilation.

- Ductwork.

- Fan coil unit.

- Heat recovery.

- Humidity.

- Mechanical ventilation.

- Natural ventilation.

- Smart connected HVAC market.

- Ventilation.

Featured articles and news

Grenfell debarment investigations paused

By request of CPS to safeguard integrity of criminal proceedings. The community reacts.

Delivering for tenants; National Retrofit Hub

New report offers recommendations to strengthen energy efficiency standards to protect private renters.

Government consultations for the summer of 2025

A year of Labour, past and present consultations on the environment, the built environment, training and tax.

CMA competitiveness probe of major housing developers

100 million affordable housing contributions committed with further consultation published.

Homes England supports Greencore Homes

42 new build affordable sustainable homes in Oxfordshire.

Zero carbon social housing: unlocking brownfield potential

Seven ZEDpod strategies for brownfield housing success.

CIOB report; a blueprint for SDGs and the built environment

Pairing the Sustainable Development Goals with projects.

Types, tests, standards and fires relating to external cladding

Brief descriptions with an extensive list of fires for review.

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.